cryptocurrency tax calculator us

Suppose John earned 020 BTC from mining on a day when Bitcoin was worth 34000 20 34000 6800. Updated Feb 22 2022 at 841 pm.

Irs Crypto Tax Forms 1040 8949 Koinly

Enter the price for which you purchased your crypto and the price at which you sold your crypto.

. The federal tax rate on cryptocurrency capital gains ranges from 0 to 37. It allows you to calculate the profit and loss from cryptocurrency trading calculate capital gains or losses and take deductions on expenses. There are cloud-hosting tools specifically designed for crypto miners.

18 hours agoExperts agreed that investing in cryptocurrencies was never a safe option per say as they are subject to risk and volatility as we have been seeing since the beginning of January. Citizen that dabbled in cryptocurrency over the 2021 tax year will now be expected to file a tax return to the IRS. How much tax you pay will depend on how long you hold your Bitcoin.

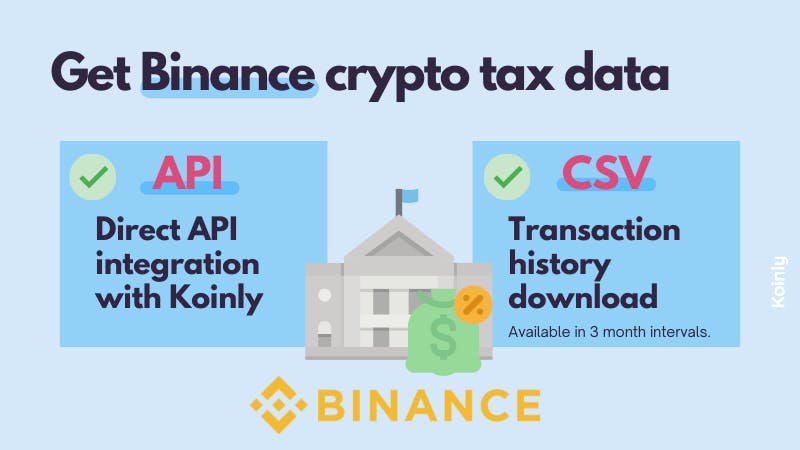

Then the crypto tax calculator will download your data and start calculating your taxes. Select your tax filing status. We recommend TokenTax which is a crypto tax software platform and crypto tax calculator that vastly simplifies the process.

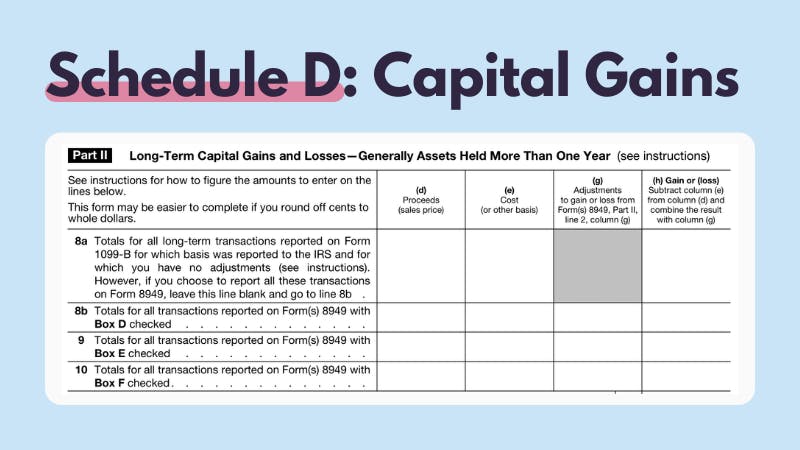

There are many benefits of using a cryptocurrency tax calculator. It also automatically calculates a users capital gains and losses simplifying the process of calculating tax returns and generating a draft Form 8949 on sales and dispositions. Expanding on the capabilities of the EY CryptoPrep tool released in summer 2020 this new tax calculator imports transactions from numerous major cryptocurrency coins and exchanges.

You may also find out whether you have a capital gain or loss. The price of BTC grew to 38000 at the end of the tax year 20 38000 7600. Zen Ledgers Bitcoin Crypto Tax Calculator.

Some of such advantages are mentioned below. For most people this is the same as adjusted gross income AGI. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms.

This same crypto coin was scaling new highs during the second part of 2021 when it made. Let us do that for you. Bitcoin for example is trading at a value of 21000 right now.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20. You simply import all your transaction history and export your report. Buying goods and services with crypto.

Gains and losses are calculated in your home fiat currency like the US Dollar to help you file your taxes with ease. Crypto tax calculators work in several ways. They compute the profits losses and income from your investing activity based off this data.

Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code. 10 to 37 in 2022 depending on your federal income tax bracket. The cryptocurrency tax calculator provides a 100 accurate answer every time removing any possibility of human error.

To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or loss and compare your tax outcome of a short term versus long term capital gain whether you already sold or you are considering selling. Our free cryptocurrency tax interactive will help you estimate your taxes on your sales whether you received your. Crypto tax software is a tool that allows you to prepare your taxes for your cryptocurrency assets.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. Essentially every time you achieve gains in crypto and realise those gains by cashing out youre creating a taxable event. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets.

You can discuss tax scenarios with your accountant. An IRS 8949 cryptocurrency tax form must be filled out for every sale or transfer of mined cryptocurrency. It helps you connect to exchanges track your trades generate the needed forms and automatically compile your tax report.

The second way is uploading your transactions as a CSV file. To use this crypto tax calculator input your taxable income for 2021 before considering any crypto gains and your 2021 tax filing status. In many cases this sort of software also includes a complete crypto portfolio tracker and analysis tool to get a bird eye.

What are the benefits of Fisdom cryptocurrency tax calculator. Calculate your cryptocurrency taxes and get your IRS compliant tax reports. The cryptocurrency tax calculator USA is an easy online tool to estimate your taxes on short term capital gains and long term capital gainsThe calculator is based on the principle of taxation enumerated by the IRS in the latest notice.

Blox supports the majority of the crypto coins and guides you through your taxation process. Capital losses may entitle you to a reduction in your tax bill. 1 Calculate Your Cryptocurrency Income Tax.

Our unique algorithm will easily calculate your complex crypto taxes proliferate your unique dashboard to track your coins and gains and also generate your crypto tax report within seconds. Blox free Pro plan costs 50K AUM and covers 100 transactions. After obtaining your CSV file and crypto data you login to your account with us at Crypto Tax Calculator Australia and upload your CSV file.

According to Shehan Chandrasekera from Forbes. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. The first and immediate step you need to do while working on calculating your crypto taxes is checking the market value equal to fiat currency when you initially receive the coins.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. You can check out our Free Cryptocurrency Tax Calculator which will answer all of your questions concerning cryptocurrency Bitcoin other alt-coin transactions and provide an estimate of how much you will be taxed among other things. Depending on your tax bracket for ordinary income tax purposes long-term capital gains which are recognized when an asset is held for at least one year one day are taxed at a rate of 0 15 or 20.

As a result you got a 1 BTC on the 1 st of march. Satisfaction Support. Select the tax year you would like to calculate your estimated taxes.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. We offer full support in US UK Canada Australia and partial support for every other country. For example you started mining one year ago.

Your specific tax rate primarily depends on three factors. Enter your states tax rate. Be sure to add how long youve owned the cryptocurrency.

As per the IRS cryptocurrency or any virtual digital transactions are taxable by law just like transactions in any other property if you gained. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Enter your taxable income excluding any profit from Bitcoin sales.

The first one and the easiest and most reliable is connecting your exchange or wallet through an API key or public address. If you use Bitcoin to pay for any type of good or service this will be counted as a taxable event and will incur a liability.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Top 10 Us Crypto Exchanges For Tax Koinly

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How To Calculate Crypto Taxes Koinly

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Do Your Binance Us Taxes Koinly

Cryptocurrency Tax Calculator The Turbotax Blog

Defi Tax Usa Irs Defi Crypto Tax Guide Koinly

Understanding Crypto Taxes Coinbase

Irs Crypto Tax Forms 1040 8949 Koinly

Best Crypto Tax Software Top Solutions For 2022

Cryptocurrency Tax Calculator The Turbotax Blog

Crypto Taxes How To Calculate What You Owe To The Irs Money